MACRA OPTIMIZATION

PAYMENT ADJUSTMENT EXPLAINED VIDEO

WHAT IS MACRA?

The underlying foundation of Value-Based Care (VBC) is not based on limiting care or quality. It’s about aligning optimal patient care with financial benefit – for the patient, for the doctor, and for the unsustainable cost of healthcare to our overall economy.

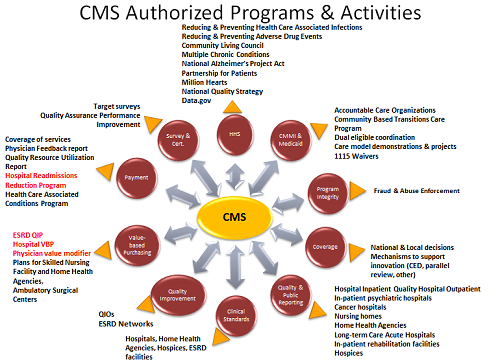

The Quality Payment Program’s (QPP) Medicare Access and CHIP Reauthorization Act of 2015 (MACRA) was enacted in 2017 with a gradual ramp-up in requirements until it went into full effect on January 1st, 2022. And now the CMS National Quality Strategy (NQS) is added even more complexity.

Compliance is Now Incentivized

Up until 2022, the QPP & MACRA was just a compliance checkbox issue and a nuisance. But now all MIPS eligible TINs, physicians, and clinicians receive a positive or negative payment adjustment. You will receive up to 9% more, or up to 9% less on your Medicare Part B claims submissions, based on your TIN or ACOs Corresponding Performance Year Final MIPS Score. (note* Critical Access Facilities & Federally Qualified Healthcare Clinics are exempt).

CMS calculates your ACOs, TINs, or Eligible Clinicians (ECs) total performance threshold score (Merit-Based Incentive Payment System (MIPS)) based on the following Category Weights Scores:

- Certified Quality Measures (CQM) – 30% of total score

- Promoting Interoperability (PI) – 25% of total score

- Improvement Activities (IA) – 15% of total score

- Cost – 30% of total score

To learn more about PI, see our HIE Optimization webpage and watch our HIE Optimization Explained video.

<img src=“CMS-Activity-Chart.png” alt=“CMS Activity Chart” title=“MACRA Page Pic 2”>

MACRA requirements make up of thousands of pages of regulations in the Federal Registry and are a very complicated beast and no small task to manage or optimize. And now the NQS is adding even more complexity.

Though most TINs did a good job meeting Quality Measures in the past, due to apathy, complexity, and the failure of vendors to provide TINs and their providers with the proper tools, many are being penalized or missing the opportunity to qualify for the maximum payment adjustment of 9%.

Administrators even boast about their Quality Scores and robust QA audit teams and provider education. However, they are still apathetic about verification and actions needed because up until now the requirements have not amounted to any significant increase in revenue. This has now changed.

So, now when ownership, boards, and/or stakeholders ask why your TIN received a negative adjustment, or failed to maximize the payment adjustment under the QPP & MACRA, and no one can explain why or do anything about it, ignorance or apathy will not be an accepted excuse. Don’t let this happen to you!

MACRA IS WORTH MONEY$$

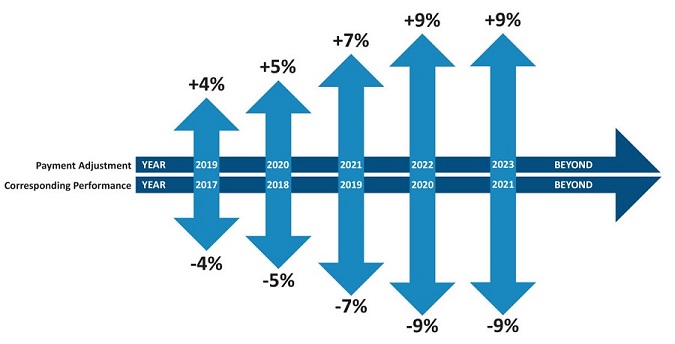

The chart below shows how the MACRA payment adjustment works.

There is the Corresponding Performance Year (CPY) and the Payment Adjustment Year (PAY).

The CPY is the 12-month period during which Quality, Promoting Interoperability, Improvement Activity, and Cost data is gathered, and after the close of the year, submitted to CMS. Around 6-months later, CMS calculates the payment adjustment (based on each TIN and physician’s MIPS score the population of the revenue neutral pool, which is capitalized from the physicians who are penalized).

The PAY is the 12-month period during which the CPY’s financial adjustment is applied.

Due to Covid, almost all providers were granted an exemption on MIPS, so the revenue neutral pool was not populated from the decrement of eligible physicians and clinicians. However, this has now changed.

For CPY 2022, CMS estimates that more than 35% of all MIPS eligible TINs, physicians, and clinicians will be penalized with a negative payment adjustment on their Medicare Part B claims submissions throughout PAY 2024. And this means the top performers will see a higher payment adjustment.

Make sure you don’t leave any money on the table. Qualify for up to the maximum payment adjustment in the next PAY.

Understanding the financial implications of the QPP & MACRA helps in making the decision on whether to invest in MACRA Optimization / Registry Services or stay the course with your ACO, vendor, or your own year-end submission very easy.

The only thing worse than failing to maximize your payment adjustment is not taking the simple steps to qualify for it. And that’s exactly what most decision makers are doing.

THE MACRA OPTIMIZATION CYCLE

Optimization consists of a 9-step process that can only be achieved with an Active or On-Going Program that follows a regiment of extract, report, analyze, plan, and act for each quarter or month. And only by taking each step can you earn exceptional Category Weights and a Final MIPS score that will qualify for the maximum payment adjustment in the next PAY.

MACRA is much more than a year-end submission exercise or a periodic measure calculation. You can’t improve performance by looking at your metrics after the year is over. And simply making numbers available a couple times a year only improves things a little.

At times your Category Weights and MIPS score may not be complete and/or accurate. And while some solutions can be applied retroactively, many require that coders or physicians change the way they describe things, or even change physician behavior.

Many so-called MIPS or MACRA experts’ (vendors) give lip service to CMS quarterly or monthly requirement of integration and feedback. They get by with a dashboard that clients can look at any time. Such a passive approach is NOT reliable. The fact is – a dashboard is the least reliable of all.

What Else is Required

For TINs with fewer than 100 physicians & clinicians, it should be enough to run reports from your EHR quarterly, post them to a standalone MACRA database for performance analysis, and discuss shortfalls against targets. For complex multi-TIN organizations, MACRA Optimization steps need to be done monthly.

Sophisticated program analytics is required because raw MACRA data doesn’t mean a lot to TIN management, physicians, or clinicians. By adding the financial impact, this creates a clear frame of reference. And once CMS publishes their Physician Compare content, the MACRA team should study the impact of public scores on the flow of new patients.

Many mid-to-large sized TINs may need at least one person with the expertise, time, and resources (including access to external expertise) to maintain or achieve the highest performance status.

If you’re an ACO member or already working with a MACRA or MIPS vendor or Registry, you still need an independent 3rd party review of their work to ensure they’re following up on all requirements. Because you can’t afford to find out if they’re not after the fact.

ELIGIBLE CLINICIAN PAYMENT ADJUSTMENT

Eligible physicians and clinicians (ECs) that are paid on a fee-for-service system or offered a bonus based on the number of patients they see or the quality of care they provide can earn more on Medicare Part B claims submissions under the QPP & MACRA.

Since qualifying for the maximum payment adjustment requires ECs and their TINs to coordinate their data, optimize CQM, PI, IA, and Cost, and file a supplemental MIPS submission both as a TIN and individual ECs (CMS will choose the higher scores), you should not depend upon your TIN or ACO to maximize your qualification status.

We request your help in scheduling a 15-30-minute Zoom call with your decision makers (Ownership, Managing Partner(s), CFO, and/or Controller).

EC PAYMMENT ADJUSTMENT EXPLAINED VIDEO

PAYMENT ADJUSTMENT REMITTANCE VERIFICATION

In PAY 2024, CMS reports that more than 21% of all MIPS eligible TINs, physicians, and clinicians will be penalized with a negative payment adjustment.

It is estimated that up to $3.6 billion will be redistributed to 2022 top MIPS performers in 2024.

You can find your payment adjustment in your QPP Detailed Final Report. But you need to verify the payment adjustment on each claim you submit because it will not be easy to identify and will require a bit of calculation to show if it is correct. It will show as a dollar amount on your remittance advices, but to determine if it is accurate you will need to convert it to a percentage and compare it to the expected percent for the submitting physician, which will not appear on your remittance advices.

The Payment Adjustment Remittance Verification pulls the expected percent from the CMS / QPP database and compares that value to the value calculated on your Remittance Advices.

MIPS CATEGORY WEIGHTS DATA ANALYSIS

Maximizing your payment adjustment begins with the MIPS Category Weights Data Analysis.

To determine the best course of action, we must first find out where you are hitting and where you are missing. We will utilize publicly available CMS data, and data you supply us from your QPP Detailed Final Report, ACO, Electronic Medical Records (EHR) system, Practice Management System, and/or other manual sources.

The process will take a little time and effort on your part, but we help make this as simple as possible for you. You should expect to spend an hour or two working with us to extract the data points required. The research, analysis, and final report effort will take several manhours to complete. Within two business days, we will be ready to discuss the analysis finding and recommendations with your decision makers.

BEST-IN-CLASS PROVIDER PARTNER

Our Provider Partner is a MACRA & HIE expert and CMS Certified Clinical Qualified Registry that specializes in the processes of MIPS and MACRA Optimization for financial ROI.

They support thousands of independent and hospital-based physicians & clinicians, multi-TIN organizations, and ACO members. As a Certified Clinical Qualified Registry, they’re a CMS approved entity that collects clinical data from MIPS eligible TINs, physicians, and clinicians (both as individuals and groups) and submits it to CMS on their behalf for purposes of MIPS (reporting options are limited to measures within MIPS and the Quality Payment Program).

They possess a knowledgeable team of people that handle all necessary tasks and provide frequent reporting and useful analysis.

RESERVE A CALL WITH US

In a 15-30-minute Zoom call, we’ll talk about our MIPS Category Weights Data Analysis, which will value verify your payment adjustment on up to 100 of your recent claims submissions and identify the steps you’ll need to take to maximize your payment adjustment in the next PAY.

In a 15-30-minute Zoom call, we’ll talk about our MIPS Category Weights Data Analysis, which will value verify your payment adjustment on up to 100 of your recent claims submissions and identify the steps you’ll need to take to maximize your payment adjustment in the next PAY.

Take a few moments to download our MACRA Optimization flyer, the 2024 CMS MIPS & PFS Final Rule Changes, the NQS, and our NCND. Complete and email it to: support@livewellaps.com. Then reserve a Zoom call with us.

- Click Here to download the 2024 CMS MIPS & PFS Final Rule Changes (zip)

- Click Here to download the NQS 2024 (pdf)

- Click Here to download our Mutual NCND (pdf).

- Click Here to go to our Calendly page to reserve a Zoom call (complete the required fields and when asked “purpose of call,” click: MACRA Optimization).